FAQ

Browse through the most frequently asked questions. See guide if you're experiencing issues with installation and running the Idena Node. Can’t find an answer? Email us at ..

Proof of person

The uniqueness of participants is proven by the fact that they must solve and provide the answers for flip-puzzles synchronously. A single person is not able to validate herself multiple times because of the very limited timeframe for the submission of the answers.

The validation status of a participant is not forever. It expires when the next epoch starts. Participants should prolong their validation status for every new epoch.

Technically, an account can be sold and bought. However, the Idena protocol introduces economic incentives to prevent participants from doing that. A person who sells their account can simply kill the cryptoidentity afterwards to unlock their frozen coins (frozen coins accumulate for each account as a part of UBI and cannot be spent while the account is valid).

To sell an account, the seller provides a copy of the account's private key. The buyer cannot be sure that another copy of the private key will not stay with the seller. Thus, the private key enables the seller to kill the cryptoidentity at any time, and the buyer would not have an economic reason to buy an Idena account.

Where to start

To use Idena only for sending coins, you just need to download the app. To create a cryptoidentity and start mining coins, you should receive an invitation code from a validated participant of the network and use the code to apply for validation.

New invitations can only be sent out by validated members. Join the official Idena Telegram chat and follow instructions in the pinned message to get an invitation from validated members or the Idena team. Invitations should be granted for free. Do not pay money for an invitation because the person who sells an invitation can terminate the invitation and issue a new one.

Please notice that validated members have limited number of invites (1 or 2 invites). The person who invites you gets invitation rewards for 3 subsequent validations passed by you. If you are not going to participate in the upcoming validation, please notify the person who invited you so they could have a chance to find another invitee and get an invitation reward.

You also get a part of invitation rewards based on the inviter's stake. The higher the inviter's stake, the more reward you get if you pass the validation. The reward are sent to your stake. If your inviter is penalized for a reported flip, the invitation rewards are not paid neither to the inviter nor to you. Please see details here.

Be aware that person who invites you can terminate your Candidate account until you get Newbie status.

- Download and install the Idena Node and Idena Client executable files or build them from source.

- Subscribe to the Idena Announcements Telegram channel to follow updates.

- Join the official Idena Telegram chat and follow instructions in the pinned message to get an invitation code.

- Make sure your node is synchronized, and activate the invitation code. Check your identity status; it should be "Candidate."

- Check the next validation time: ... Your node must be synchronized before the session starts.

- Learn how to solve flips: read the article in our blog and test yourself.

- Solve the flips during the validation time. Be agile. The first 6 flips must be submitted in less than 2 minutes.

- Once your account is validated, keep your node up and running in order to mine coins.

- Learn how to create flips. Don't forget to create three flips before the next validation in advance. Schedule your next validation.

The pace of network growth is restricted to minimize the probability of a Sybil attack.

The Idena protocol introduces incentives to prevent participants from buying and selling invitations. The person who sells an invitation can kill the invited participant and get the staked/locked coins during the next several epochs before their status is "Newbie". The seller can double-spend the invitation by selling it multiple times. Invitations should be granted for free to trusted people only (relatives, friends, and so on).

The targeted number of invitations in the network is calculated as 50% of the network size after each validation (Idena foundation invitations remaining extra).

Invitations are distributed as follows:

- Identities with the Human status get one invitation starting with the highest Total score.

- If there are non-distributed invitations left, identities with the Human or Verified status get one invitation starting from the highest total score.

- After the distribution, the minimal Total score of those entitled to receive invitations is known.

- All identities with this minimal Total score receive invitations. If needed, additional invitations are issued by the Idena protocol to cover the demand.

The core Idena team is granted to issue a limited number of invitations per epoch to support the network growth. The number of available invitations for the foundation address is limited to min(500, NetworkSize*0.1))

Every account in Idena has two wallets: the Idena wallet and the stake. The stake is like your pension account: 20% of all your Idena rewards (mining, validation rewards, flip rewards, valid invitation rewards, and so on) accumulate in the stake, while the remaining 80% goes directly to your Idena wallet.

The stake cannot be spent while your account is valid. You receive these coins in your Idena wallet only when you voluntary terminate your Idena account - that is, when you “kill” your cryptoidentity.

When your account is killed by the network protocol, you lose your stake.

Idena does not use the stake for governance purposes.

Discrimination of identities with the Newbie status

Only 20% of earned coins is mined to the main wallet for Newbies. The rest 80% is mined to the stake: in total 60% of earned coins is temporary locked in the stake until a Newbie becomes Verified.

60% of earned coins will be sent back to the main wallet once a Newbie becomes Verified.

Newbies cannot terminate their identities to withdraw the stake.

Newbies cannot participate in the governance of the network. While adresses with this status can get rewards for mining and participating in oracle votes, their votes are not counted and do not make a difference in the final outcome of a voting: they cannot influence a hard fork voting or an oracle voting.

Validation session

The date of the validation session is calculated by the network and is shown in the Idena app. The time is always fixed: 15:00 UTC.

The bigger the network is, the less frequently the validation sessions happen. Read more.

The validation time of 15:00 UTC covers most countries when most people are awake. These are the local times for some of the world's cities (as of June 1, 2019):

- San Francisco, USA 8:00

- New York, USA 11:00

- London, UK 15:00

- Berlin, Germany 16:00

- Moscow, Russia 18:00

- Delhi, India 20:30

- Beijing, China 23:00

- Tokio, Japan 24:00

The short validation session has a very limited time frame, less than two minutes, and consists of six flips, each of which is received only by 1–4 participants in the network (depending on the network size). This session’s task is conducting a Turing test: telling humans from AI.

The long flip qualification session lasts 30 minutes and consists of 25-30 flips, each of which is received by a larger number of network participants (depending on the network size). This session enables the network to achieve a consensus on flip quality and the right answer to a flip.

To get validated, you need to meet these three requirements during each validation session:

- Your current short validation session’s score should be 60% or more.

- Your total score for the last 10 short validations (including the current validation session and all the previous ones) should be 75% or more.

- Your current long session’s score should be 75% or more.

In addition, you need to solve flips both correctly and fast. The first 6 flips must be solved in less than 2 minutes.

The validation status of a participant is not forever. It expires when the next epoch starts. Participants should prolong their validation status for every new epoch. A validated person may miss two validation sessions in a row without losing her cryptoidentity. But then this person cannot mine coins during the epochs when validations have been missed.

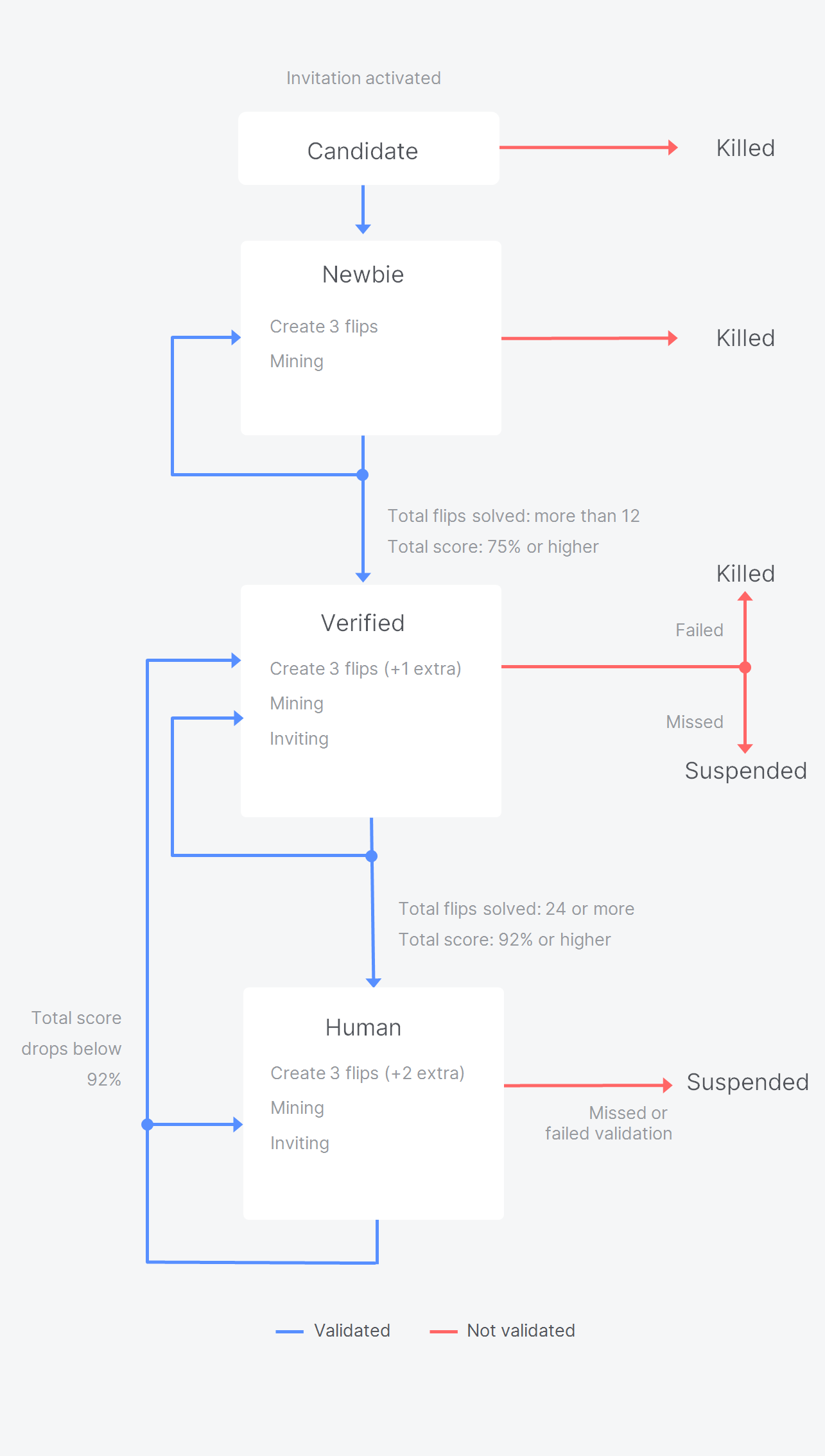

Fig: Identity status flow (Candidate, Newbie, Verified, Human)

Total score>=75% can do the same as a Newbie plus- send out invitations

- submit one extra flip

- miss up to two validations in a row

A Verified cannot fail neither a short nor a long session.

Total score>=92% can do the same as a Verified plus- submit two extra flips (five in total)

- fail a short and long session without being killed

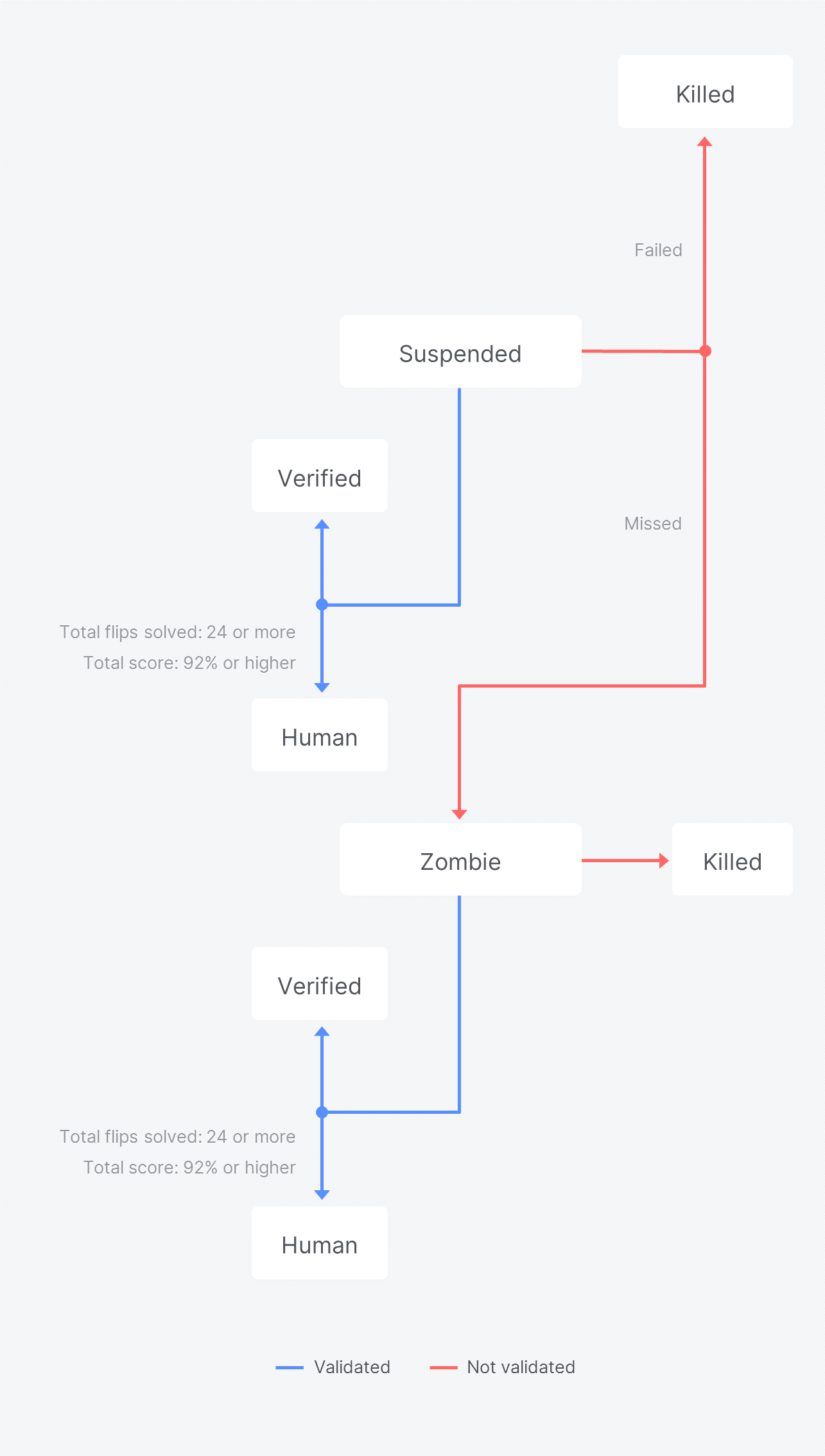

Fig: Identity status flow (Suspended, Zombie)

The validation time needs to be synchronized for people all over the world to verify the uniqueness of network participants. Otherwise, it would be possible to verify a different account at each of the various validation ceremonies.

Newbies and verified accounts must submit flips before the next validation ceremony. Not submitting flips is equal to missing a validation.

Candidates, suspended accounts, and zombies do not submit flips for the validation ceremony.

If your cryptoidentity is killed by the network, you lose your stake: 20% of all your rewards (mining, validation rewards, flip rewards, valid invitation rewards, and so on), which cannot be spent while your Idena account is valid and which can be received only when you voluntary terminate your account.

The remaining 80% of all your Idena earnings go directly to your Idena wallet. You keep those coins even if your cryptoidentity is killed (by you or by the network protocol).

It is possible in the one of following cases:

- If one of your flips is reported by the majority of qualification committee (please see What if one of my flips is reported)

- If all of your flips have status No consensus which means that the network could not reached consensus about the right answer for these flips.

or

Please notice that flips are the key element of Idena network security. That is why the protocol imposes severe penalties on users that create flips in breach of the rules.

As Idena is a decentralized and distributed network it uses a gossip peer-to-peer protocol to ensure data disseminated to the network.

To consider your answers valid they should reach more than 50% of validated nodes no later than 15:02 UTC.

Also, the keys of your flips (for previously validated users) should spread across the network no later than 30 secs from the beginning of validation.

If your node lost connection while submitting the answers/keys and connection was restored after the above time, the validation attempt will be considered as failed with the Late submission reason.

- Low-performance computer or home router;

- You have synced the node right before validation and the node did not manage to find enough peers for stable connection.

We recommend you to keep your desktop node synchronized at least 30 mins before validation, upgrade your hardware if possible or use Idena web app (app.idena.io) with a connection to one of shared nodes for validation.

Flip challenge

Validated participants create flips to be able to take part in the next validation session.

For now, they can't. But Idena is designed as an open-source project, and we hope that there will be teams with specific expertise in this area who will be motivated to develop means for people with disabilities to get validated in the network, such as audio flips, for example.

A flip is submitted without the right answer. The network comes to a consensus about the right answer after the validation session.

If consensus is not reached, then the flip is disqualified. Answers for disqualified flips are not counted. Authors of disqualified flips get no reward for making them.

Flip has strong consensus if there are not less than 75% of participants agreed with the answer. Participants who gave right answer get 1 point, otherwise 0.

Flip has weak consensus if there are at least 66% of participants agreed with the answer. Participants who gave right answer get 1 point, otherwise 0,5.

The network comes to a consensus about the right answer after the validation session. If consensus is not reached, then the flip is disqualified. Answers for such disqualified flips are not counted.

As the network grows, the number of people solving the same flip goes down: In a network of 10,000 users, only two different participants will have the same flip to solve. When the network reaches 30,000 users, one single flip will appear in a validation session of only one participant.

The flips are stored as encrypted data in the network before validation, and then they are algorithmically distributed.

The flips are encrypted according to the following protocol:

- Every flip has a public and a hidden part:

- the public part is available for everyone after the validation (2 images)

- the hidden part is available only for the participants who solve the flip - An author generates 2 keys for flip encryption:

-FlipPublicSecretfor the encryption of the public part of the flip

-FlipHiddenSecretfor the encryption of the hidden part of the flip - All flips created by the author are encrypted using these 2 keys and broadcasted into the IPFS

- Flip lottery

- The author calculates the list of candidates who must solve the flips in order to send them FlipHiddenSecret

-FlipRecipients[N]array is produced:FlipHiddenSecretis encrypted N times with candidates' public keys (N is the number of participants who must solve the flip)

-FlipRecipients[N]array is encrypted withFlipPublicSecretand broadcasted to the IPFS

- Candidates download arraysFlipRecipients[N]corresponding to the flips they have to solve - Once the validation ceremony starts at 15:00 UTC, all the authors broadcast their

FlipPublicSecret.

- Candidates decrypt arraysFlipRecipients[N]corresponding to the flips they need and extract theFlipHiddenSecretusing their private key.

- Other participants can decrypt only public parts of the flips using sharedFlipPublicSecret.

Flips belong to the class of AI-hard problems. There is no single pattern for flips since they are created by humans according to randomly selected keywords.

Flips do not fall under the class of "recognition" problems, which are easily solved by neural networks. Solving a flip demands understanding the meaning of a story, using common-sense reasoning.

The example of the Winograd Schema Challenge shows that introducing a larger database does not lead to better results with AI-hard tasks.

In addition, adversarial noise can be added to flip images to make a neural network result in incorrect outputs.

Thus, current AI instruments or even a large database of flips will not achieve the results that can be compared to those demonstrated by humans.

You should report the flip when you see one of the following:

- One of the keywords is not relevant to the flip

- You need to read the text in the flip to solve it

- You see inappropriate content

- You see numbers or letters or other labels on top of the images indicating their order

Every successful report of a flip is rewarded: The reward for the reported flip which is not paid to the flip creator is distributed between the committee embers who reported the flip.

The number of flips that can be reported is limited to 1/3. So participants are motivated to pick which flip to report first relying on objective criteria (e.g. both keywords relevance).

Flips are the key element of Idena network security. The protocol imposes severe penalties on users that create flips in breach of the rules. If one of the flips is reported during the validation, the user that created this flip will not get any rewards for the validation. A flip cannot get status Reported by accident. This status is given if more than 50% of qualification committee have reported this flip during the long session. Every member of qualification committee can report only 1/3 of flips that are shown to them.

Flip creation

To create a flip, you use two keywords randomly selected by the protocol as associative hints to think up a story within the general template of “Before – Something happens – After.” You upload four images from your device or from the Internet to tell the story. Then you create an alternative – a meaningless sequence of the images that you have chosen by shuffling – and submit the pair of sequences to the network.

Please follow the rules when creating flips:

- both keywords should be clearly visible in the images

- flips should not contain any numbers or letters or other labels on top of the images indicating their order

- flips should not contain any sequence of enumerated objects

- flips should not content any text that is necessary to understand to solve this flip

- flips should not contain any adult content (18+, NSFW)

- flips should not contain several unrelated stories

- flips should not include waking up template

- there should not be thumbs up/down image at the end

- do not insert images of both keywords into a page/screen/painting

If you don’t follow these rules when creating a flip, it can be reported at the qualification session. Please keep in mind that in this case you will not be paid for validation (see What if one of my flips is reported).

These two random keywords selected from a large dictionary are a sort of associative hint for stimulating your creativity. You are required to use them for two reasons. First, doing so helps to ensure the non-repeatability and unpredictability of flip types, which makes flips truly AI-resistant. Second, it enables the Idena protocol to detect and punish protocol abuse such as submitting a number of random pictures instead of a flip or the same flip repeatedly.

Network participants must create flips relevant to the suggested keywords. If you are not sure of the meanings of the word, or if you cannot think of a story with the suggested words, click the Change my words button, and a new pair of words will appear. You are given 9 pairs of words to create three flips each epoch.

The relevance of the flip to the keywords is tested during the long qualification session. Participants who create flips that are irrelevant to the keywords are penalized by the protocol. Identities will be killed for repeatedly ignoring keywords when creating flips.

Flips are created by validated identities.

The network comes to the consensus about the right answer after the validation session. If consensus is not reached, then the flip is disqualified. Answers for disqualified flips are not counted, and the authors of these flips are not rewarded.

You cannot keep flip drafts for the next epoch, because the keywords used for flip creation are generated for the current epoch. All the drafts will be burnt after the validation session, and you will have to create new flips.

Users creating meaningless flips or spam or flips with inappropriate content or flips irrelevant to the keywords are to be punished.

Flips are distributed randomly. Participants are not allowed to solve flips created by themselves.

Delegation

You can delegate your mining status to another address which in this case will act as a pool.

For example, if several members of your family have Idena nodes, you can benefit from delegation to one pool. Only this pool node has to be online to mine coins for delegated nodes. Pool rewards for block mining will be equal to those of a single identity.

Mining and validation rewards will go to the pool address. Your address will get only the part of rewards that goes to your stake.

Please keep in mind that your identity could be terminated by the pool owner and you can lose your stake. That is why we strongly recommend to use delegation only if you trust the pool owner.

You can disable delegation in the next epoch only.

No keys are transferred from the delegating node to the pool. The fact of the delegation is stored only on the blockchain.

However, the pool owner can terminate your identity and take your stake.

Any validated user can delegate their mining status to a not validated address which will become a pool.

Yes, you need to stay validated so that the pool can keep mining coins for you.

Yes, you can vote in any Oracle voting and get rewards in accordance with the specific oracle voting. These rewards will go to the pool address.

However, to determine the results of the Oracle voting only the last vote sent from the pool is counted.

Economy

In addition to the rewards for flips, reporting "bad" flips, invites, the Idena protocol offers rewards for staking. Unlike traditional linear staking, where large coin holders benefit the most, Identity Staking allows small-scale stakeholders to earn a higher APY than larger stakeholders. The Identity staking rewards are paid only to validated identities in proportion to their stake raised to the power of 0.9

Only validated identities can earn Identity staking rewards. There are two types of rewards you can earn.

- Validation rewards. You can get Identity staking rewards for the successful validation once per epoch in addition to the basic rewards for invites, flips and reporting. The bigger your stake the more you get for validation.

- Mining rewards. Mining rewards are paid out in real time as long as you keep your Idena node up and running while your mining status is activated. You can run the Idena node on your laptop in the background. It does not require a mining rig and does not consume much electricity. By running your own node you contribute to the network security and decentralization.

You can calculate your estimated Identity staking rewards here:

https://www.idena.io/staking

Please be careful as you can lose your stake for missing or failing validation depending on your identity status.

If you want to withdraw your stake you need to terminate your identity. You can not withdraw your stake until you get Verified status. We recommend you to start staking your coins only when you have Human or at least Verified status. However you can take a risk and start earning staking rewards even with Candidate status.

| Status | Validation rewards | Mining rewards | Stake protection |

|---|---|---|---|

| Candidate | + | N/A | No |

| Newbie | + | + | No |

| Verified | + | + | Partially |

| Human | + | + | Yes |

| Suspended | + | N/A | Depends on age |

| Zombie | + | N/A | Depends on age |

- Candidate. You can stake the coins and get staking rewards for your 1st validation. However, before your 1st validation the user who gave you the invitation code can terminate your identity and burn your stake. If you still want to stake, please do not miss or fail your validation. Otherwise, the stake will be burnt. You won’t be able to withdraw your stake until you get validated at least 3 times in a row and get the Verified status.

- Newbie. You can stake your coins and earn both rewards for validation and rewards for running your own Idena node. 80% of your rewards will be locked in your stake until you get Verified status. 60% of these rewards will be sent back to your wallet once you reach Verified status.

Please keep in mind that while you have a Newbie status you can not terminate your identity and withdraw your stake. You need to reach Verified status to be able to do it. - Verified. You can not fail the next validation, otherwise your coins will be burnt. However, you can miss validation and get Suspended status. With Verified status you can terminate your identity to withdraw your stake.

- Human. Human status allows you to stake your coins safely. You will not lose your stake even if you fail or miss the next validation. However, your status will be switched to Suspended.

- Suspended. You can not earn mining rewards with Suspended status. However, if you join the next validation you can earn the staking rewards for validation and restore your Human status. If you fail your next validation your stake may be burnt depending on your age (see table below). If you miss your next validation your stake will remain and you will get Zombie status.

- Zombie. If you miss the next validation the stake will be burnt. However, if you fail your next validation then only a part of your stake can be burnt depending on your age. Remaining part will be sent to your main wallet.

| Status | Age | Burnt stake | Sent to main wallet |

|---|---|---|---|

| Suspended or Zombie | 5 | 5% | 95% |

| Suspended or Zombie | 6 | 4% | 96% |

| Suspended or Zombie | 7 | 3% | 97% |

| Suspended or Zombie | 8 | 2% | 98% |

| Suspended or Zombie | 9 | 1% | 99% |

| Suspended or Zombie | 10+ | 0% | 100% |

Total supply is not limited.

Total minting is capped at 51,840 coins per day. Half of the cap (50%) is mined while producing the blocks. The rest of the coins are minted during validation sessions.

Block reward: 6 iDNA

Maximum number of blocks per day: 4,320

Mining cap per day: 25,920 iDNA (50%)

Accumulating fund per day: 25,920 iDNA (50%)

Total cap: 51,840 iDNA

There are the following cases for supply utilization:

- 20% of minted coins are frozen in stakes

- Stakes of non-validated identities are burnt

- Mining penalties are burnt

- 90% of transaction fees are burnt

- 1% of the minted coins are frozen in the zero wallet

- 100% of ad payments will be burnt: read more

- The bigger the network the more coinholders will just hold newly minted coins without spending them

Account gets a penalty equal to 8 hours of burning mining.

An Idena validator receives the mining penalty if their node is inactive for more than 1.5 hours. The miner status for the penalized account is deactivated automatically. Account gets a penalty equal to 8 hours of burning.

To continue mining, the mining status has to be activated manually. As the validator’s node returns to mining, the penalty time decreases, and the mined coins are burnt.

How is the mining penalty charged?Every node tracks activity of other nodes when new blocks are produced. There are two subsequent blocks that have to be mined to penalize an offline node:

- 1. Penalty proposal block (

OfflinePropose bit is activated)Nodes are voting for a penalty proposal by a special bit in their vote messages:

TurnOffline.- 2. Penalty execution block (

OfflineCommit bit is activated)The block is created if consensus for the penalty proposal mined in the previous block is reached.

The transaction fee is calculated automatically by protocol. The fee goes up or down based on how full the previous block was, targeting an average block utilization of 50%. When the previous block is more than 50% full, the transaction fee goes up proportionally. When it is below 50% usage, fees go down. A user can specify the maximum fee limit for the transaction.

transactionFee = currFeeRate x transactionSizecurrFeeRate = max( 1e-16, 0.1/networkSize, prevFeeRate*(1+0.25*(prevBlockSize/300Kb-0.5)) )

Fig: Transaction fee calculation

Validation ceremony transactions are not charged. However, they affect the fee rate because of the block consumtion.

90% of paid fees are burnt. The rest 10% are paid to the block proposer.

There is a fixed cap for minting Idena coins equal to 51,840 iDNA per day:

- Block mining cap: 50%

- Staking reward fund: 9%

- Candidate reward fund: 1%

- Flip reward fund: 7.5%

- Extra flip reward fund: 10%

- Invitation reward fund: 9%

- Report reward fund: 7.5%

- Idena foundation payouts: 5%

- Zero wallet fund: 1%

The validation session fund is capped at 25,920 iDNA per day. It accumulates daily (according to the number of blocks issued) and gets distributed at the end of the validation session. Please see the validation rewards distribution here.

No rewards are paid to those participants who fall into one of the following groups:

- Participants who have at least one reported flip

- Participants who have no qualified flips

- Participants who provided invalid data instead of flip images

Idena formalizes people on the blockchain and there might be use cases that we can not anticipate yet.

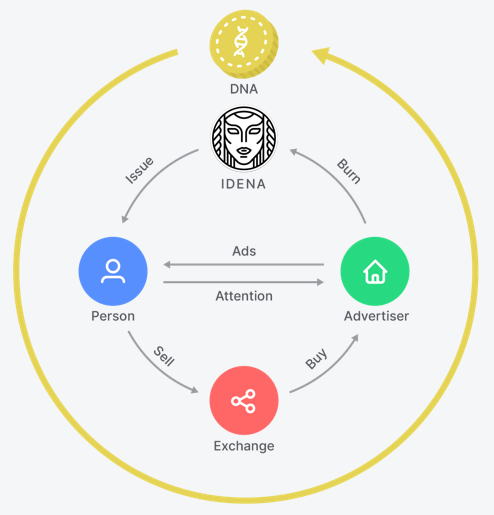

Onchain marketingIdena participants voluntarily agree to consume ads published by a valid address which burns coins. Multiple advertisers compete for attention of a certain group of users by burning coins. This is an auction: Whoever burns more coins has the right to show their ad. Burnt coins are removed from the total supply. Newly mined coins are equally distributed among the network participants and then can be sold to advertisers who will have shortage of coins.

Fig: Closed tokenomics fuels the demand for the Idena coin

1% of all issued coins is accumulated at the zero wallet address. We believe that a governance for the zero wallet fund allocation will be established in future. It can be used for the external projects funding, covering someones losses or for some other purporses the network agrees on.

There is no private key for the zero address. The network must reach consensus in order to spend it.

How to buy iDNA?

Create an account on one of the exchanges where iDNA is traded. Trade iDNA and withdraw it to your wallet. If you want to hold iDNA long-term, we do not recommend storing your coins on the exchange for safety reasons.

You can use the Idena Web App or one of the Idena wallets created by the community to store your iDNA. Choose a wallet you want to use, generate your address and use it to transfer your Idena coins. In general, storing coins in a private wallet is safer than keeping them on an exchange.

You can buy wrapped iDNA on a decentralized exchange using your metamask wallet. Open pancakeswap, click Trade and connect your wallet. Read more about using your metamask wallet with BSC blockchain to trade iDNA.

If you have traded wrapped iDNA on BSC blockchain and want to store them on the Idena blockchain, you can swap your iDNA using the Idena Bridge.

Attacks

This is a general safety assumption applicable to any permissionless blockchain and it is not possible to overcome it: More than 2/3 of honest participants are needed to guarantee safety.

Let's look at Bitcoin proof-of-work. Consider selfish mining when the biggest miners are getting bigger. As a result, small miners do not invest in Bitcoin mining since it contributes to their losses. As a matter of fact, there is highly concentrated mining in Bitcoin that cannot ever be reverted. There are thirteen controlling pools in Bitcoin. There are three pools controlling more than 50 percent of the Bitcoin network.

The captcha test starts synchronously at the same time worldwide. Answers must be submitted within an aggressive timeframe. An attack requires extensive coordination of a high number of unique workers.

In addition, since the validation timeframe is relatively small (1–2 minutes), the workers might be interested in validating their own identities instead of selling their time during the validation time.

Attack: An adversary offers a flip service that creates high quality flips using the set of words you specify. Participants who don't want to spend time creating flips can outsource this job to the service. If the service has enough users it can auto-solve a significant number of flips.

The threat can be mitigated by introducing a punishment mechanism: An account can be killed for submitting a compromised flip for validation. A flip is considered compromised if it has been seen by other people before the validation time. A hash of the proof published on the blockchain prior the validation can be considered as evidence. The person who provides the evidence earns percentage of the stake of the terminated account.

Effectively, once you decide to submit at least one flip provided by a flip service, you take a risk that your account may be terminated by this service in future.

A flip service can not prove that it does not publish evidence of compromised flips. It will hardly be profitable to build such a service on reputation since there is a strong incentive to kill accounts later on when more accounts are compromised and the total stake of those accounts is big enough.

Attack: Users in an attacking pool share the flips they submitted to the network with other users in the pool before the validation. This allows the pool to validate Sybil accounts.

Assume the total network size is 1000. An adversary has a pool of 100 people colluded. the adversary knows the answers for 10% of flips in advance. This means the adversary can validate 1% of Sybils by colluding (10 accounts).

On the next round the adversary knows 11% of the flips so they can validate 1.1% of Sybils (11 accounts). The adversary can only grow extensively: More and more real people have to collude.

Compared to PoS, getting 10% of the actual humans in the network to collude is harder than merely having capital equivalent to 10% of the network’s market cap.

Attack: AI can learn to solve flips by having a huge dataset of flips produced by a big network: 1 million network of people will generate millions of flips per epoch which is enough for machine learning.

The threat is mitigated by flips encryption. Each flip is available only for those participants who solve it during the validation session. There are around 10-15 persons who see it. The flips that have been used for validation are encrypted: Only 2 out of 4 images of a flip are publicly available to make it impossible to easily collect huge datasets.